As Layoffs Stack Up There Are Positive Signs

May and June have seen an increase in layoff activity. That will continue, but there is good news.

I sat in my car in shock. Sort of. The truth is that I had seen it coming. One day I had been at the office printer when I found a report someone in my department had printed titled, “Outsourcing Your Accounting to India”. I grabbed the materials I had printed and the report and walked into my boss's office. Andy assured me that I had nothing to worry about. I was part of the Accounting Department, as the leader of the collections team at a local newspaper where we collected from businesses that hadn’t paid their ad spend bills, but that collections weren’t being outsourced. I didn’t believe him. A few months later I was part of the layoffs.

That wasn’t the first time or last time I was part of layoffs. The very first time was right before I moved to Japan. I was part of an insurance sales call center. I had already given my notice, so being laid off was a blessing for me since I could a severance package regardless.

The last time I got laid off was when our daughter was about 9 months old. That layoff hurt the most because I had other people to provide for and I was the top producer on the team. This layoff I also saw coming. When I received a meeting request scheduled downtown at the bank’s headquarters I look at my boss’s calendar to see if I could figure out what was going on. When I saw my whole team scheduled in back-to-back meetings, starting with me, I knew what was going to happen.

Layoffs are Stacking Up

With inflation still high and the public markets not performing well companies are starting to brace for a tough economic environment. From JP Morgan Chase’s Jamie Dimon warning of an impending economic “hurricane” to numerous prominent venture capitalists publicly warning the startups they have invested in to get lean. Those startups are listening. In the tech startup sector alone there were over 15,000 layoffs just in May. June has started off to look even worse in the tech startup sector, with layoffs ranging from 8%-25% of total staff at various startups losing their jobs.

Tech startups aren’t the only companies laying off staff. I first noted layoffs occurring in the mortgage industry. As rates climbed applications dropped and the response was for those companies to start laying off people.

Even mighty Tesla has announced the belief that they need to lay off 10% of their staff. Whether that is to prepare for an economic winter or because Elon seems to believe that companies are often bloated with unnecessary headcount, an opinion he has shared about Twitter, is yet to be seen.

There is Good News

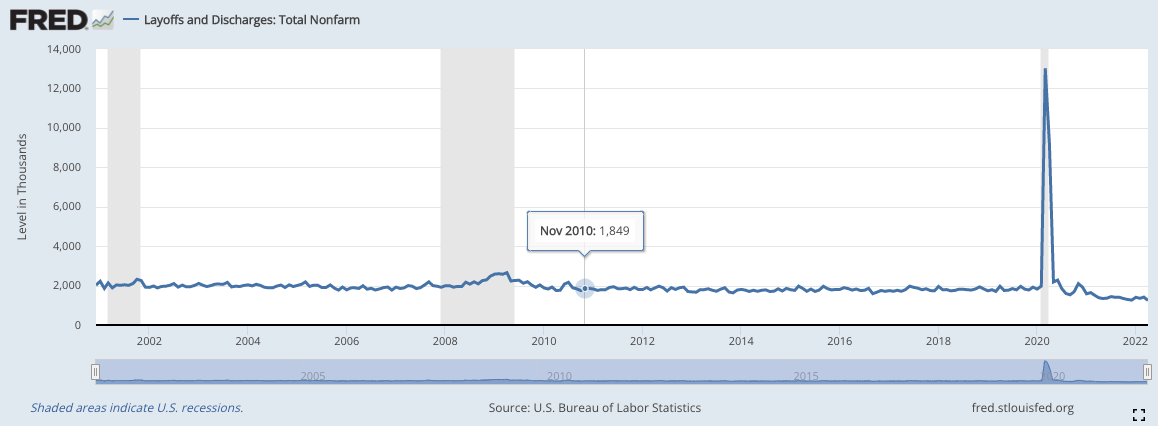

The Great Recession technically started in December of 2007. Up until then, layoffs were historically pretty flat.

That December roughly 1.9M people were laid off. That is out of a total workforce of around 153M people at the time. So, just over 1%. Of course, that doesn’t take into account total hiring. Unemployment at the time hit 5%.

In April of 2022, the same chart shows right at 1.25M in layoffs. If you go back to December 2020 and exclude the pandemic (which is that big spike on the above chart) you can’t find one other month that is lower. In fact, the trend line for layoffs has been heading south.

That does not mean May’s report won’t show an uptick. Combined with June it probably will. But, we have a long way to go to reach Great Recession levels.

Reading the Tea Leaves

Having been through multiple layoffs myself it is times like these that make me nervous. If you have already been laid off or you are worried that your company might pursue layoffs let me share a few thoughts on what I think is going to happen and what you can do about it all.

I personally learned my lesson after my most recent layoff. Here are the things I have done to shelter myself and my family from tough economic times.

1) I’ve worked diligently to pay off debt

2) We have more than 6 months of an emergency fund built up

3) We accomplished #1 and #2 by watching our expenses, but more importantly we have used income generated from side hustles to accomplish those goals.

4) For the past ten years I have continually added new skills to my resume. From web design to content writing to programming (my most recent upskilling)

As for what the tea leaves say, I continue to stick to my prediction that we are going to see around 12-18 months of a slower economy. But, I don’t think we will hit the same levels as the Great Recession unless a few things happen (such as the war in Ukraine extends beyond the two directly active countries, China has more economic hiccups, China invades Taiwan and the U.S. responds, another really bad coronavirus outbreak, etc.).

I do think more layoffs are coming. Particularly over the next three months while we all wait to see what the Fed’s interest rate plan (I’m calling for 50 bps this month and 25-50 bps in July at this stage) will do to tamp down inflation.

One, possible, silver lining to a slow economy is that we should see fewer people quitting jobs, e.g. The Great Resignation. While the job market has been an applicant’s dream I expect that to change in most career paths. Except for technology, such as programming, where demand will remain high for the right talent. Applicants with those skills may lose some bargaining power, but I don’t think they will lack job opportunities.

So, my advice? Scroll back up and work on steps 1-4. But not necessarily in that order. If you don’t have a head start on #1 and #2 then I would start with #3 and #4, which feed off of one another. There are skills you either have or can quickly pick up that can help you produce some additional income. That income can then be used to attack #2, an emergency fund. Once you get that secure start getting rid of debt. Meanwhile, look at your budget and make sure your spending is within, or preferably, lower than your means.