Here’s Why an Amazon Stock Split is Happening

Today we will see an Amazon stock split. Here are some reasons why the company might be performing a stock split.

Let me share an investing principle I have that has served me well. I like to focus on individual stocks that I can afford to buy a lot of shares in, instead of buying stocks where the price per stock is really high. My rationale is that by owning more stock shares I have the opportunity to take advantage of exponential growth.

For example, I once owned over 9,000 shares in a biotech, cancer-research firm. I had bought them as a penny stock when the price per share was under $1. Over the span of a few days the price per share shot up to over $6. I sold about 50% of my holdings in that company. If you do the math, that was a big gain.

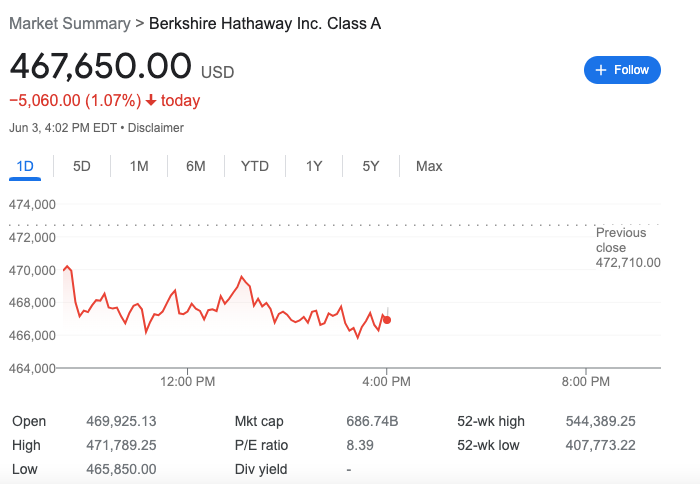

It isn’t as likely that a high dollar per share stock will shoot up 6x over a few days. For example, Berkshire Hathaway A Shares are up over $450,000 per share! It’s virtually impossible for them to shoot up to over $2 million per share.

There are other reasons that many companies do not like their per-share price to be too high. In those instances, they perform a stock split. Before we get to those reasons, let’s make sure everyone understands a stock split.

Understanding a Stock Split

Companies have a certain number of shares that are outstanding at a given moment. You can find the number of outstanding shares in a few ways. For example, with Berkshire Hathaway A shares just take the market cap (686.74B) and divide by the per-share price ($467,650) and you will get roughly 1.5M shares outstanding. Side note - public math is scary. 👻

Or, better yet, let’s use an example of a well-known stock that is splitting today. An Amazon stock split will occur today, June 6th, 2022. It will go from around 509M shares to 10.2B shares. Note that the number of shares goes up in a stock split. A reverse stock split is when the number of shares goes down. Also, note that the total value of the company, its market cap, will not change at all! That is because the price per share splits accordingly. In the instance of an Amazon stock split, it goes down. Again, public math.

Why an Amazon stock split?

There are some benefits to performing a stock split.

- An Amazon stock split will expand the shareholder base. Right now, the market isn’t open yet, the shareholder base is limited to the number of people and companies that own the 509M outstanding shares. There is the opportunity for a lot more investors to own shares when there are 20x more available. Unless, of course, those same people and companies hold onto all of the shares they own.

- Performance is typically better after a stock split. Amazon’s stock was sitting at around $2,484 per share, which is down from its high of $3,773. Some studies point toward a lower performance level during the 12 months following a stock split, but the long-term consensus appears positive. Here’s one positive, but older, opinion on the strategy.

- Another reason is that the stock split announcement brings attention to the company. I’m not sure that Amazon needs a lot more attention, but the folks I know in public relations say that you can never have enough of it. So, an Amazon stock split could be an attention/branding exercise for the company.

Reading the Tea Leaves

I’d tell you that an Amazon stock split could have another reason behind it. I sense this is all part of a larger strategy to appear more in line with the “common man”.

Granted you can already purchase fractional shares of Amazon through most platforms (I use Robinhood), but lowering the price per share makes the stock more accessible to everyday investors.

Also, Amazon’s employees are in the middle of unionizing. You might not think that a stock split has much to do with unionizing. But, they can be related.

DISCLAIMER: I am not a financial advisor and none of the content on this channel is financial advice. All information is provided for educational/entertainment purposes. If you are making an investment or other financial decisions and require advice, please consult a suitably qualified licensed professional.