Pop Goes the Consumer Debt Bubble

There is a consumer debt bubble looming and it could easily pop. Here are the numbers that lead me to believe that and what I am doing about it in my own life.

A housing market that is completely out of whack. Layoffs are beginning to stack up. One-quarter of negative Gross Domestic Product (GDP) growth is already on the books and another (this quarter) is likely to be the same. Which will mean we are in a recession, not just headed toward one. I’ve been feeding you this information for months now.

Today, I am going to add to the list of troubles in the U.S. economy that many won’t have noticed. We have a credit bubble that is likely to pop.

Consumer debt highest since 2007

U.S. household debt increased by $1 trillion in 2021. That is the largest amount of an increase in 14 years, or since 2007. Think about that year, 2007. What happened in 2008-2009, the years following another period when consumer debt rose by a large amount? In the form of a Jeopardy answer, the current answer is “What is the Great Recession, Alex”.

In the fourth quarter of 2021, total consumer debt hit $15.6 trillion. During that period, mortgage debt increased by $260B. Driving by home prices that were up 27% year-over-year due to the rise in home prices.

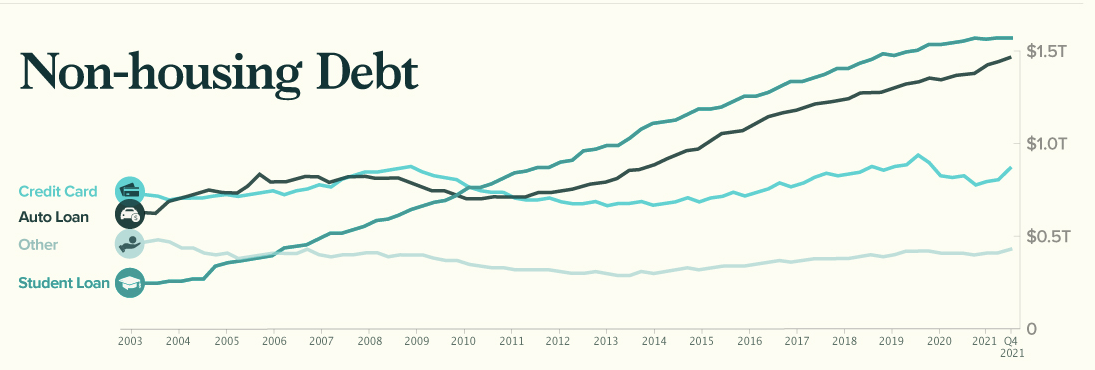

According to the Federal Reserve Bank of New York, sourced on the Visual Capitalist site, auto loans were the fastest-growing category (I contributed to that statistic). You can see these stats in the graph below.

How Did We Get Here?

Human beings just can’t help themselves. Having been flush from stimulus money, coupled with lockdowns that hindered their ability to spend money, consumers got to use to a level of lifestyle that wasn’t one of their own making. People who didn’t have discretionary income to invest in the stock market became investors in cryptocurrencies and NFTs. They bought houses that were much more expensive than they could have normally afforded because interest rates were so low.

Will the Consumer Debt Bubble Pop?

Many people believe that it won’t. They point at things such as rising wages and better credit quality. Here’s the thing. Even though the job market is solid right now, wages are not keeping up with inflation. The rising interest rate environment we are in will erode some of the credit quality that existed. Especially borrowers who are on the fringe that spent money they didn’t really have. Pair that with an increase in layoffs, with more coming, I think we have some challenges on the horizon.

What I am Doing

I rarely tell you what you should do about these things. Instead, I try to share what I am doing.

I did buy a used car within the past two months. My vehicle was 10 years old and nearing 200,000 miles. I wanted to get the most I could out of it while the car market was hot and take advantage of lower interest rates before they tick up (which they have since). Because of my trade-in, I was able to finance a lot less than the vehicle’s purchase prices. I could have paid cash for the vehicle, but I am using my cash for investment opportunities that can earn far more than I am paying in interest. Plus, with our limited debt, we have more than enough cash flow to cover all of our expenses.

We have looked at new homes in the past but we have decided to sit tight due and wait for the housing market to cool where prices should settle down.

What am I saying? We are living well below our means. On top of that, I am always looking for ways to create additional income through side hustles and investing. I’ll be using that income to pay off the new car as quickly as I can. That is just a personal choice, rather than investing it, because I like having next to no debt.

If you can hold off, right now is not the time to stretch your budget. Right now is a good time to hoard cash, especially if you don’t have six months in reserves set aside, keep your budget flat or find ways to reduce expenses, while looking for ways to make some extra money.

Enjoy this post?

Please consider sharing it with other people who might be interested in this type of content.

Or, if you have suggestions for topics you'd like me to cover just hit reply and send me your suggestions.