Hello friends and welcome back to the Product in Public newsletter, where I give you an inside look at how I help companies attract capital and build better products.

Before we get to today's newsletter, here’s some of the content I’m consuming that you might find interesting.

What I’m consuming

Lots of economic and financial data.

Three of my favorite sources are:

- U.S. Government Accountability Office - an independent (questionable, since it “works for Congress”, non-partisan agency meant to keep our government honest

- Senior Loan Officer Survey - released quarterly, this report is due anytime now. I read it to understand the state of debt in the U.S. Which I suspect is not good right now.

- Federal Reserve Economic Data (FRED) - all kinds of reports are available. I especially watch the unemployment rate, GDP, and inflation data.

I’m 50 this month. Which means I catch myself sounding “like an old man” more and more these days.

For example, I’m consistently complaining about the cost of things.

To be fair to myself, this is part getting older and part (maybe a large part) that the cost of things is out of control. Particularly when compared to the ZIRP era.

I’ve engaged in multiple online conversations about the state of the economy in the U.S. lately.

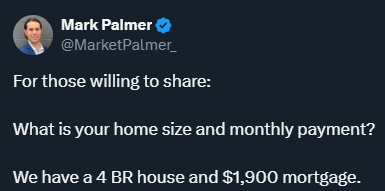

Mark Palmer sparked a discussion about housing on Twitter.

This post resonated with me because my family is in the same shoes as others. Our mortgage payment is LESS than what we would pay to rent a reasonably good apartment, let alone buy something new. With mortgage rates over 7.5%, if we bought, we would be more than doubling our interest rate.

I have not been able to verify the data points, but I shared the following post from LinkedIn with my wife this morning.

That is a little small, so I’ll summarize - it's now 100% more expensive to buy a home in 2024 compared to 2020. From an average of $1,400/month → $2,750/month.

People continue to feel the pinch of the past year or more of high inflation. Couple that with the fact that most people believed rate cuts (the Fed was signaling three cuts) were coming when the inverse could be true (it is now possible we get a rate increase before the end of the year).

So, I set out to uncover if the economic data looks as bad as it did right when the 2008 Great Recession kicked into gear. Note - it started in December of 2007 and ended in June of 2009.

To make my determination, I took a look at seven sets of data. To be fair, there are others I could look at, but these seven are consistent indicators of economic performance.

Most sources are recognized reputable providers such as the Bureau of Economic Analysis, etc.

| Data point | Q1 2008 | Q1 2024 | Winner |

|---|---|---|---|

| GDP | 0.6% | 1.6% | 2024 |

| Average household income | $50,303 | $77,283 | 2024 |

| Fed Funds rate (upper-end) | 4.25% | 5.50% | 2008 |

| Rate of inflation | 4.2% | 3.5% | 2024 |

| Unemployment rate | 5.1% | 3.8% | 2024 |

| Wage growth | 4.0% | 4.7% | 2024 |

| Consumer confidence | 97.76 | 79.4 | 2008 |

In a vacuum, these comparisons aren’t perfect. That said, they do tell a story.

Just about every data point favors 2024 versus 2008 at the moment. The only spot where things are worse today than in 2008 is in Consumer Confidence. Meaning, that people are not feeling as confident about the state of the economy.

Over a year ago, I shared that wage growth was the one data point keeping the U.S. out of recession. While wage growth might be higher than in 2008, but it is struggling to keep up with inflation.

So, what’s the verdict? What does this comparison tell me?

Things aren’t as bad as they have been in the past. That makes me feel better.

That said, we are hanging on by a thread.

There is a reason Consumer Confidence is so low.

I’m not just being an old man.

Things are very expensive these days.

Food costs have risen by 25% since the start of the pandemic.

In one year alone, from January 2021 to December 2021, new car prices increased by 19.6%.

Home prices in my area are out of control. Some estimates say they increased by 30% between 2020 and 2024.

I think that is low.

Just yesterday my wife shared a listing of a new construction home that is the same size as my 10-year-old home and it’s going for 3x what I paid for mine, or 2x what mine is valued at. Trust me, that has nothing to do with finishes.

While the economic indicators may not seem as dire as they were in 2008, it's hard to ignore the reality of high prices and the growing unease among consumers. The cost of living continues to rise sharply, and it's more important than ever to make informed financial decisions.

You need to remain vigilant and proactive, understanding the economic landscape and adjusting our strategies accordingly. Until next time, keep an eye on those numbers, and remember - you're not alone in feeling the pinch.

If you’ve found this information helpful, I hope you’ll do two things for me.

1) Subscribe to this newsletter. That way, new copies are delivered directly to your inbox.

2) Share this newsletter with one other person that you think might benefit from the information I share.