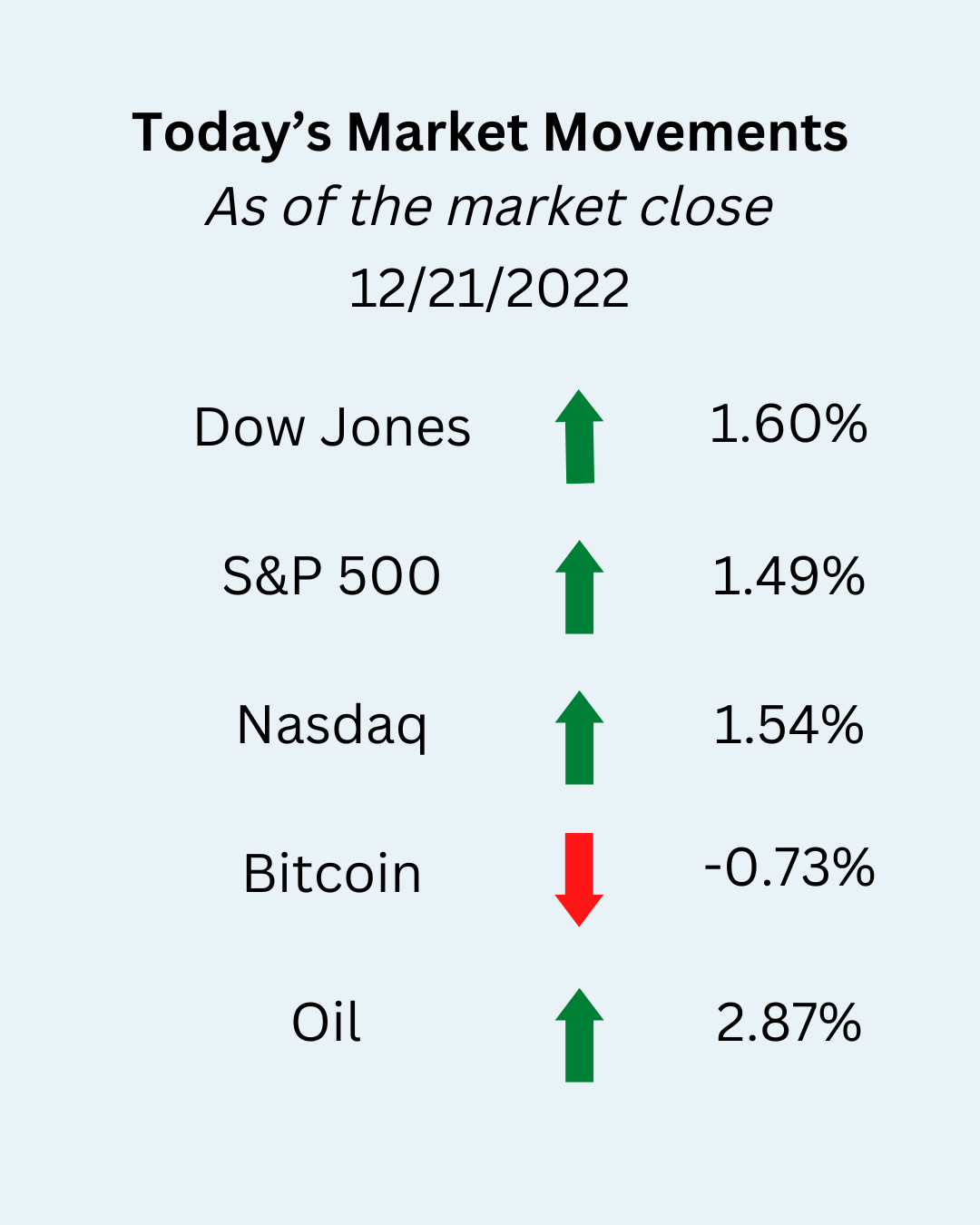

Ho freaking ho! The Santa Clause Rally is on!

The markets showed the potential for a true Santa Clause Rally. Can it hold up?

Santa Clause 🎅 comes to town.

I’m having to eat my words here. The other day I said that it looked unlikely we would see a “Santa Clause Rally” in the markets. However, yesterday morning futures for the DJIA, SP 500, & Nasdaq all showed signs of an end of year bounce back.

The markets have all week to continue the rally, with Christmas falling on the weekend this year. However, next week will be a shortened trading week as Monday, the markets are closed. (Source: Standard)

The impact of interest rates on loans versus deposit accounts and investments

I’ve been talking a lot about the rise in interest rates. And how we will see additional increases next year.

While a rising interest rate environment means that borrowing money becomes more expensive, it also means that yields on deposit accounts and investments become more attractive.

One year ago, the Fed Funds Rate (FFR) was at 0.25%. Today it sits at 4.5%. That is a 4.25% increase.

While loan rates tend to increase as the FFR increases or decreases, the correlation is not always one-for-one across all loan types. That’s because the FFR is the rate financial institutions charge one another for borrowing overnight funds. At the same time, many consumer and commercial loans are tied to other indices, such as the Wall Street Journal Prime Rate or, the past, LIBOR.

The 4.25% FFR increase has pushed the WSJ Prime Rate up the same amount. Its 52-week low was 3.25%, and it now sits at 7.50%. However, the average new auto loan, with a 72-month term, and the average 30-year mortgage rate have not increased quite that much. (Source: WSJ)

As of August 2022, the average new auto loan was 5.61%. One year earlier, it was 4.97%(Source: FRED). So, nowhere near the 4.25% increase of the FFR. Meanwhile, the average 30-year mortgage went from 3.23% one-year ago to 6.61%. (Source: WSJ)

So, in summary, loan rates often move up with the FFR. But, not in perfect alignment.

Now let’s look at deposit and investment rates to see how they move when the FFR is steadily increasing. All comparisons are one-year apart.

- Money market rates were .07%; now they are .33%

- A 5-year CD was .42%; now it is 2.76%

- The 10-year Treasury was 1.41%; now it is 3.655%

So what?

You’d be wrong if you were hoping that increases in yield through conservative investments will offset any borrowing costs you may have.

This is one reason that investors who have longer retirement timelines still need to be considering more aggressive investment opportunities. I don’t know about you, but 3.65% on a ten-year deal doesn’t excite me very much.

It’s also why holding onto cash is a good idea so that you can invest quickly when good opportunities come along.

Upcoming economic data

Today’s economic data will be full of important information.

Most notable will be 1) jobless claims, which is estimated to see a 5% increase from 211k; 2) the real gross domestic product revision (SAAR). Interestingly, it is projected to remain flat at 2.9%.

The uptick in jobless claims makes sense, as layoffs extend outside the tech sector and into other areas. I’ve even seen posts about recruiters being let go in mass from companies as they drastically slow down hiring.

Enjoy this post?

Please consider sharing it with other people who might be interested in this type of content.

Or, if you have suggestions for topics you'd like me to cover just hit reply and send me your suggestions.