The TLDR:

- I’m earning 9.14% on my USDC lent out on the Coinbase platform

- I’m also earning upwards of 4% on my USDC for simply holding it on Coinbase

- I just got my Coinbase One credit card and I’ve already earned $60 worth (or 2.5% of my spend on their card) in Bitcoin simply for using it instead of another credit card

Disclaimer: Please remember that all views expressed in this newsletter are solely my own and do not constitute investment advice. I encourage you to conduct your own research and consult with a financial advisor before making any investment choices.

One of the top qualities an entrepreneur can have is the ability to spot opportunities.

It’s something that my mentors have always told me I’m good at.

One said - “You are the only person I know that can consistently see how A plus G equals Z, when they have nothing to do with one another, long before anyone else.”

I suppose that’s fair. All three of my startups were named “first-movers.”

Today I wanted to share an example with you of an opportunity I spotted over nine years ago that is just now coming to fruition.

I’ve been a lender for almost thirty years.

I’ve done virtually every type of loan. From consumer credit cards to advanced commercial loans.

I started my banking career out as a teller. My last stint at financial institution (FI) was as a Chief Lending Officer.

At last count, I’ve been involved in $800 million worth of loans. That number is probably well over $1 billion. I just stopped counting.

For years I’ve been saying that the lending industry is ripe for disruption.

In fact, almost ten years ago I told a conference full of bankers that loans would soon be handled entirely by artificial intelligence.

At the end of that presentation, a C-suite banker came up to me and said I was wrong.

What she didn’t know is that companies like Upstart were ALREADY processing 25% of their loans without EVER being touched by a human.

Still it took almost ten years for us to see massive disruption in how loans were originated and serviced.

Sure, there were advancements along the way. Things such as using Optical Character Recognition (OCR) to import financial statement data into a loan application.

I’m here to tell you the few major advancements in lending I’ve seen in the past ten years are nothing compared to what I’ve seen in the past six months.

A few years back there was a general concern that the FAANG’s (Facebook, Amazon, Apple, Google of the business world were coming for the financial services industry. Those technological giants have massive user bases, advanced solutions, products that include the movement of money, and massive amounts of capital to deploy. Their sheer scale alone led many to believe that, should they choose to, any one of them, or all of them, could make a play into traditional financial services.

While FAANG has made inroads into financial services, including offering debit/credit cards, embedded finance, loans to merchants and more, they have largely stuck to their primary business models. Which makes sense. Apple hit $2B in market cap by being dominant in the consumer technology space. Google did so largely through owning the internet search business. No need to expand into heavily regulated industries when business is booming.

The real threat is companies like Coinbase, who through recent product launches and partnerships are essentially a quasi-financial institution at this point.

Think about it. What is a financial institution’s typical product suite?

- Deposit accounts

- Loans

- Digital banking platforms

- Debit/Credit cards

- SMB products

Coinbase, up until recently, was a cryptocurrency trading platform. Full stop.

That’s not the case anymore.

In fact, over the last few weeks alone they’ve been announcing a variety of new products and/or partnerships that have expanded their product offering by leaps and bounds.

They are all but a bank, just without the FDIC insurance.

✅ Deposits: they will securely hold your cryptocurrencies and stablecoins (more on these in a bit) for you. In fact, some reports claim that Coinbase has $400M in value on their platform. If accurate, that would make Coinbase the 21st largest bank in the US.

✅ Loans: As of April, 2025, Coinbase customers can get loans, paid out in USDC (one of two of the most popular stablecoins) against their Bitcoin values on deposit with the company. More on this in a minute. Because it really matters.

✅ Debit/Credit Cards: Six days ago, as of the time of me writing this (June 18th, 2025), Coinbase announced the One Card. A credit card with a 4% Bitcoin-back return on every purchase. I just started using mine.

✅ Digital Banking Platform: their app is world class. It’s easy to use and intuitive.

Not to mention, they are also looking at getting into the tokenized stock business, to compete with stock-trading platforms such as Robinhood, with a request for SEC approval also coming this month.

Tell me that doesn’t sound a lot like a bank’s product mix.

Or, at least quasi-banking.

All in less than six months.

For all of those reasons, Coinbase has been a sleeper that traditional financial institutions have largely chalked up to only a cryptocurrency product.

What has been ignored is that moving cryptocurrency over a blockchain is a fee-efficient method of moving money. Whereas sending a wire may cost upwards of $50, transferring the same amount of money via a cryptocurrency, like $BTC, costs pennies. Or less. On the Solana network, fees can run as low as $0.00025.

The challenge, until lately, has been the volatility of $BTC’s value. Who wants to use a highly-volatile “currency.” Although values continue to fluctuate, large swings in the value of Bitcoin have been limited recently. As of today, June 18th, 2025, $BTC is valued at over $105k per coin.

So, all you need to do is limit the volatility.

Enter stablecoins, specifically USDC.

The two largest stablecoins are Tether and USDC. It just so happens that Coinbase played a role in the creation of the USDC stablecoin.

In 2018, Coinbase and a company called Circle jointly created the USDC stablecoin. They co-founded the CENTRE Consortium, which was designed to govern the stablecoin. Then in 2023, CENTRE was dissolved and Circle took full control of UDSC issuance and governance.

Coinbase isn’t out of the picture.

Coinbase owns equity in Circle and still earns revenue both from off-platform and on-platform USDC activity.

Not only should financial institutions be worried about Coinbase as a quasi-bank, they should be concerned about the growing prevalence of stablecoins. Something traditional financial institutions aren’t equipped to handle.

If you still aren’t convinced, the largest bank in the US, JP Morgan Chase, recently announced that they are launching their own stablecoin-like token.

Stablecoins have a long way to go to fully supplant other money movement methods. USDC averages around $9B-$12B per day in volume. ACH equates to $169B per day or Fedwire with its $4.1T per day.

Still, that kind of USDC volume, which doesn’t include other stablecoins or cryptocurrency volumes, is eye-opening for such an early phase of a product’s lifecycle.

With its quasi-bank product offering and deep embeddedness in stablecoins through its role with USDC, Coinbase is the company, or at least one of the key ones, that I’d be concerned about as a financial institution or a provider of services to financial institutions.

Small banks and credit unions aren’t going to be quick to take up the use cases for stablecoins, as a general rule, and when they do they won’t be equipped to manage them.

But, guess who is and can? Coinbase. On top of deposits, loans, and cards.

All that is missing is federal insurance for deposits. Which Coinbase is actively pursuing.

Folks, this is how you disrupt an industry. You quietly eat away at its edges, attacking use cases that the competition is ignoring all together or they aren’t focused on. Then one day, bam!, you show up with an offering that looks a lot like theirs, but is more advanced, more modern, more appealing to the newer customers in the market (in this case, younger generations).

Even I wasn’t that worried about Coinbase given my experience in the industry until I saw this.

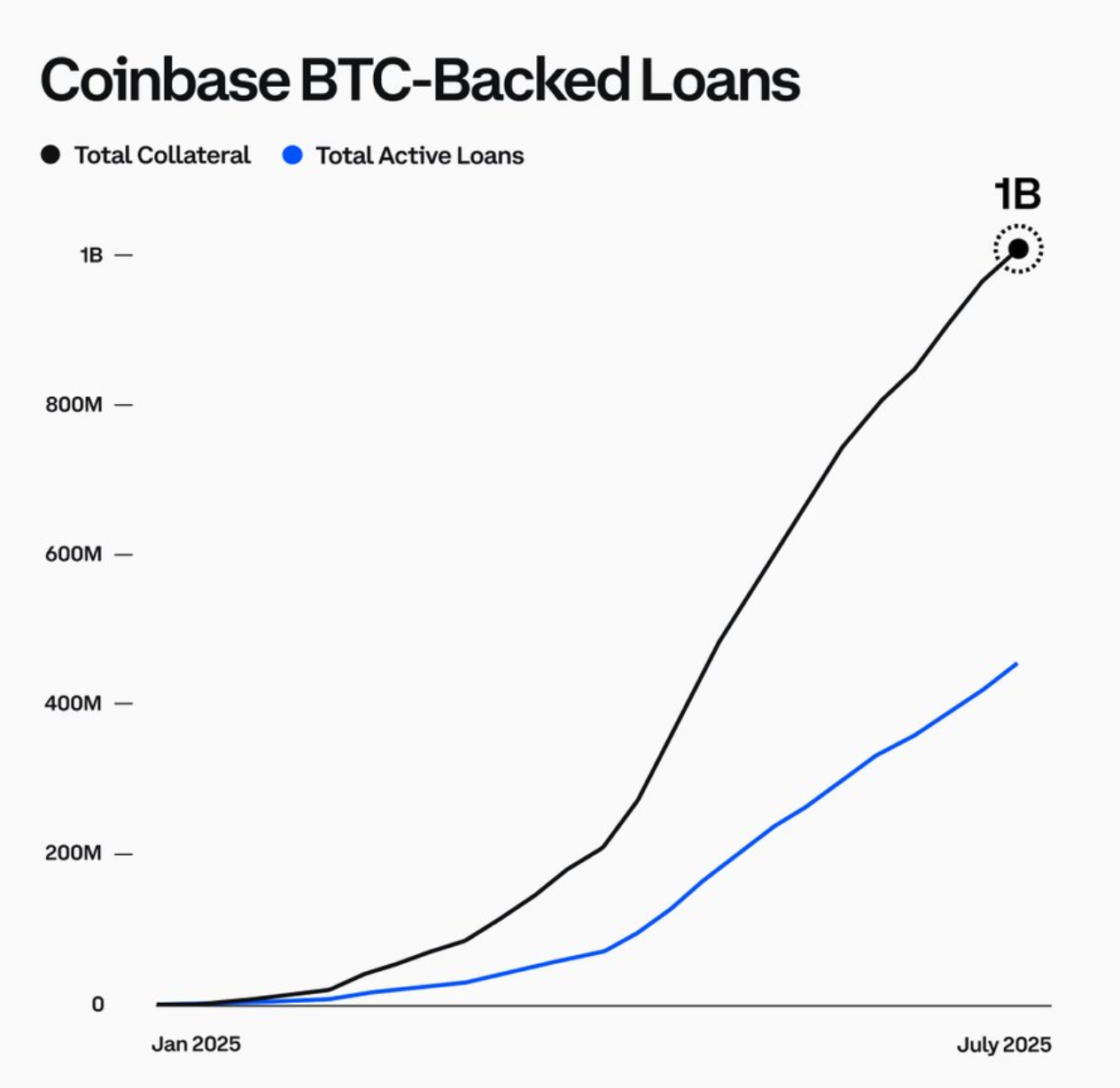

In January 2025, Coinbase started offering loans backed by Bitcoin and funded in USDC.

In six months they did over $400 million in loans. Four hundred…million.

Besides a metric <bleeped out word> ton of volume, those loans are underwritten COMPLETELY different than a normal loan.

- There are zero credit checks. Sorry FICO.

- Is possible, maybe even probable, that the underlying collateral, Bitcoin, will appreciate so much that the borrower could actually make money on the deal.

- There’s no minimum-payment due and no due dates.

Does that sound like a normal loan to you? Let me help you. Not…even…close.

In fact, I just took $5,000 worth of USDC and lent it out on the Coinbase platform. They are paying me 9.14%. Folks, I just became a lender/bank and am earning a really nice return on my money.

It gets worse.

You can have these loans in place in mere minutes. About as fast as you can click a few buttons inside the Coinbase app. It took me all of 30 seconds to do the transaction and that was just to read the details.

“Ah, these are just small dollar loans.”

Yeah, wrong again. They go up to $1 million dollar loans. That’s enough for even commercial lending purposes.

Like, I said, everything is changing and lending will never be the same.

We are entering a new world of lending - what I call the Lending Protocol.

If you’ve found this information helpful, I hope you’ll do two things for me.

1) Subscribe to this newsletter. That way, new copies are delivered directly to your inbox.

2) Share this newsletter with one other person that you think might benefit from the information I share.