Product Market Fit isn’t the goal. Sustained product market fit is the goal.

I’ve seen it many times. A product comes onto the market, gains market share, and then its growth stalls out.

The process of earning product market fit can be costly. For example, B2B startups can take as long as 18-24 months to find product market fit (Lean B2B). That’s a lot of runway being burned before a product has significant revenue.

At the biotech incubator I ran, product market fit took upwards of three to five years, due to the intense research and development and regulatory burdens the products had to overcome.

Couple the length of time it takes new products to reach product market fit with the fact that most never find it in the first place. A lack of product market fit accounts for upwards of 40%+ of startup failures (Stripe).

Not finding product market fit isn’t the only fear founders have to deal with. Its not uncommon for a product to find market fit and then lose it. That happens for a few reasons:

- Evolving customer needs

- New entrants causing shifts in the market

- Technological shifts that force quick pivots

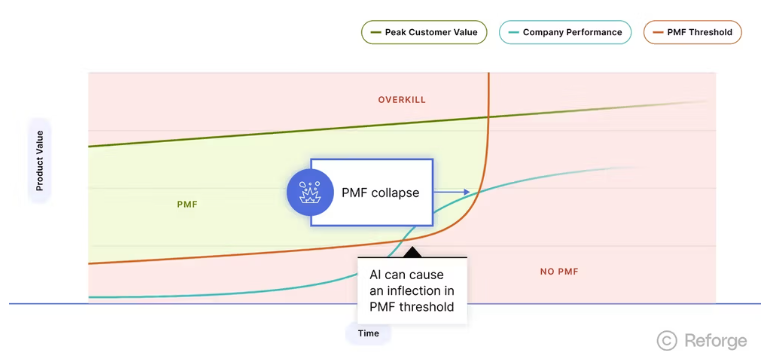

Artificial intelligence is one example of technological shifts causing product market fit flatlines.

Artificial intelligence is allowing markets to shift at breakneck speed. What once took months, and sometimes years, to evolve can happen in weeks or, in some cases, days.

Reforge called this Product Market Fit Collapse.

Fortunately, there are ways to fix a stalling product.

Let me first say that product market fit isn’t the real end goal. Platform market fit is.

What’s the difference?

Product Market Fit = You’ve found a repeatable process for selling to a specific ideal customer profile (ICP). The goal here is to increase market share.

Platform Market Fit = Multiple products have Product Market Fit. The goal here is expansion. Whether geographically or into new ICPs.

Five ways to unblock product market fit

Since product market fit means you have found a repeatable sales process for one specific ICP, finding it is all about finding specific go-to-market motions that work for that ICP.

#1 - clearly identify your ICP

Your ICP is a core set of buyers within your Total Relevant Market (TRM), not TAM, that are right for your product.

Last week I was talking with a founder and I asked them to define their ICP.

“Asia and the Middle East.”

Those are markets, not an ICP.

I’ve said it a lot, but I’m going to keep hammering it home.

You MUST know your ICP intimately.

This free template can help.

#2 - identify the right sales motions

How you sell depends on your ICP.

The way you sell a B2C product is different than a B2B product.

There are even nuances within each of those.

Cereal ads are made for kids. But they are selling to moms by using words like “nourishing” or “healthy.”

#3 - set your pricing strategies

In my world, enterprise B2B fintech SaaS, discounting is common. There are even times when we let the sales rep agree to a discount, that is capped. That speeds up the sales cycle by helping avoiding back and forth between the prospect → sales → someone with discounting authority → sales → the prospect.

A pricing strategy we use is bundling of products. This works because our customers, banks and credit unions, need lots of different products to run their business.

If you tried a bundling strategy when selling cars you’d have less of an impact.

#4 - leverage KPIs

Its hard to know how your product is performing if you aren’t tracking the right key performance indicators (KPIs).

Notice that I said the right ones.

Let’s assume you want to be an influencer on YouTube.

Tracking the number of subscribers you have matters. But guess what matters more? Things like watch time for each video, engagement like commenting, etc.

If you are tracking the wrong KPIs then you will never find product market fit.

#5 - new verticals

If you have your ICP well identified and you are using the appropriate sales motions and your pricing strategies are dialed in but your KPIs are saying something is still missing, then it could be time to try those same motions in a different market, or vertical. I’ve had to do this with one of my own products.

I was originally targeting one ICP within a market and I quickly released that there was a better ICP to target. Fortunately, by monitoring the data I was able to pivot to focusing specifically on residential mortgage brokers.

The key here is to not to move on to new verticals too quickly or too slowly.

Curious how your go-to-market strategies measure up?

Take my free GTM Assessment and learn how to improve your GTM strategies.