Let’s play a guessing game. I’m thinking about an industry where two of the publicly-traded company’s within that industry have seen their stock prices go up 48% over the last 12 months.

Can you guess what industry they are in?

You’d be wrong if you thought that they were tech stocks, or social media companies, media companies, or crypto-based companies.

I’m actually thinking about two companies that are in the agricultural space (Bunge and Archer-Daniels-Midland or ADM).

I’m actually thinking of investing in those companies and/or some commodity-based ETFs. Here’s why.

Just the other day I was listening to the All-In podcast when David Friedberg started quoting some of the statistics around how we could see a food shortage, the word famine was used, in the next year. His comments started out focusing on Russia’s impact on global food supply based on export controls that they have in place.

According to Friedberg, about 15% of global caloric intake comes from wheat production and about 33% of that wheat comes from Russia and Ukraine. The podcast episode went on a bit further on this topic, including touching on the increase in price of fertilizers and how that is impacting and will further impact the global food supply. If you’d like to check it out just head here.

The idea of a global food shortage and the importance that crops such as wheat, corn, soy, etc. play in feeding the world got me wondering if there is an opportunity to invest in those commodities as a hedge against inflation.

So, I started doing some research in order to do my own due diligence.

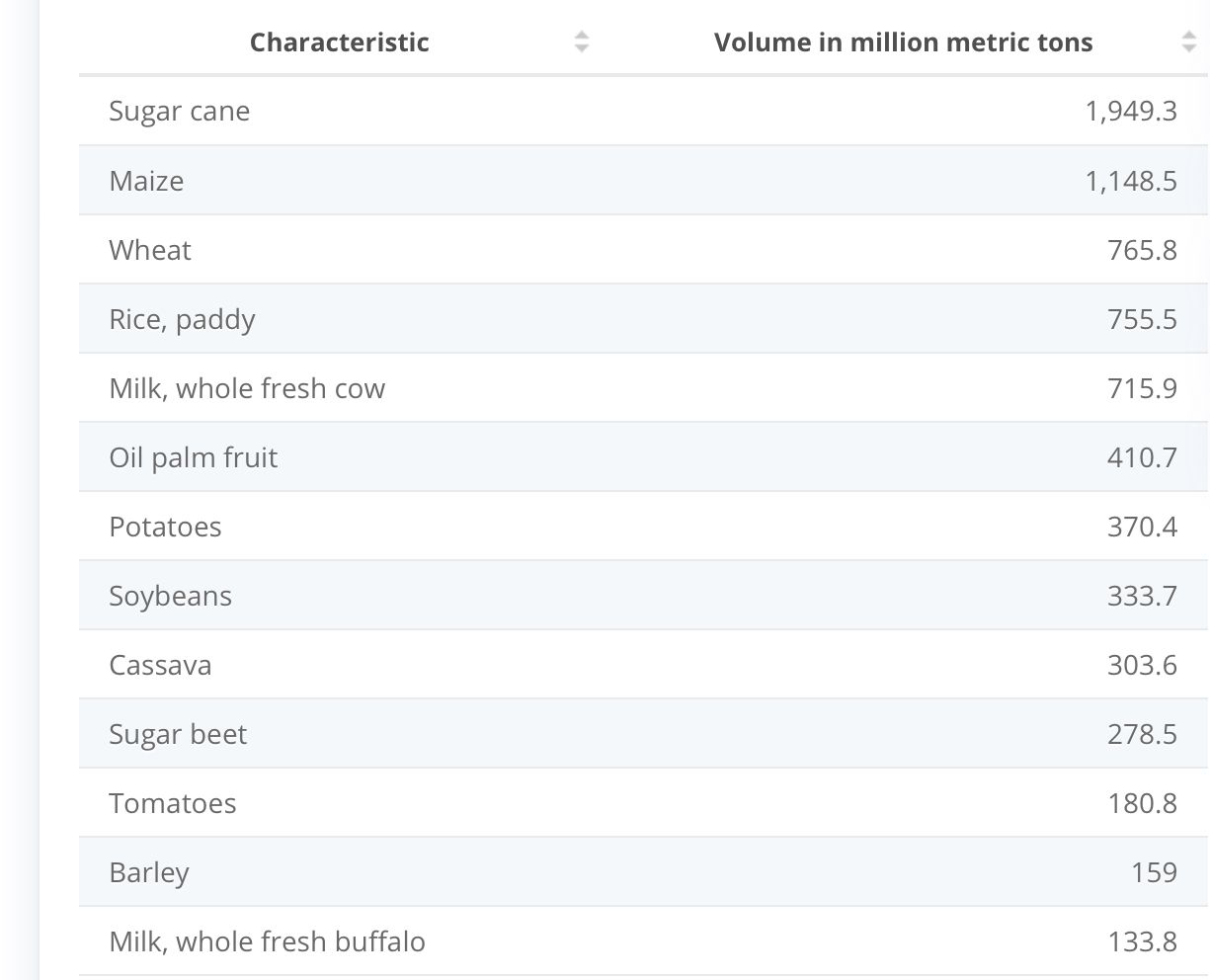

According to Statista, in 2019 wheat was the third most consumed commodity in the world. The leader was sugar cane, followed by maize (corn). Rounding out the top five included rice and milk. Other commodities such as potatoes and soybeans were 7th and 8th respectively.

In million metric tons the numbers look like this:

Specifically related to wheat production, one source I found quoted the U.S. Department of Agriculture as estimating global wheat production at around 779 million metric tons, or about 2% higher than the above figure. That would put Russia’s 75M metric tons at around 9% of global production. Add in Ukraine’s 33M and the two account for something like 14% of all wheat produced.

It looks like Friedberg’s numbers add up which also means that it is possible that the on-going war between the two could negatively impact the global supply of wheat. Especially, since both Russia and Ukraine have halted exports. The same thing occurred in 2020 when Russia halted wheat exports.

So, it sounds like the thought that there could be a food shortage is legitimate. The above examples are just regarding wheat. But, its a widely known fact that food prices in general are soaring due to inflation.

Given the law of supply and demand, that means we should expect the related commodity prices to increase. According to Trading Economics, wheat is up 27% just this month.

If you are considering investing in commodities, like wheat, like I am then there are a few ways you do so.

First, you could buy the stock of individual companies that engage in agricultural produce. The two companies I referenced above are examples of such companies. I did read during my research that ADM paused its operations associated with Russia.

Second, if you aren’t sure about owning individual stocks, you could do your commodity investing by owning any of the available ETFs in the marketplace. Examples, include ETFs ticker symbols DBC and PDBC, which are Invesco products or Teucruim’s Wheat (WEAT) or Corn (CORN) funds.

If you are a more advanced investor then you could play with swaps and options to gain some exposure to the commodities markets.

As I said at the beginning, these articles are never meant to be investment advice. But, I am always willing to share how I am thinking about making my own investments.

Based on what I have seen, I plan to buy some commodities tomorrow. Particularly around wheat. But, I plan to diversify across others.

What are your thoughts on a potential global food shortage and do you use such possibilities to develop investment strategies of your own to accomplish hedging against inflation?

Disclaimer - All information and data on this blog site is for informational purposes only. I make no representations as to the accuracy, completeness, suitability, or validity, of any information. I will not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. All information is provided AS IS with no warranties, and confers no rights. I will not be responsible for any material that is found at the end of links that I may post on this blog site. Mistakes may happen from time to time. URLS and domains may change hands. Because the information on this blog are based on my personal opinion and experience, it should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. My thoughts and opinions will also change from time to time as I learn and accumulate more knowledge.