SPACS go Splat

SPACs were all the rage in 2021. Since then they have gone splat. Here is a history of the funding vehicle and why they are struggling.

In 2021, the SPAC (Special Purpose Acquisition Corporation) craze was at full tilt. Since then they have taken a beating.

Today I’m going to cover:

- What a SPAC is, for those of you who may not be intimately aware of the funding vehicle

- The history of SPACs

- Why they became so popular

- Why they are suffering now

What are SPACs?

SPACs flip traditional venture capital fundraising a bit end-over-end. Whereas most startups raise capital and then attempt to enter the public markets through an initial public offering (IPO), SPACs raise their capital through an IPO and then merge with privately-held companies, which in turn brings that company to the public markets.

Instead of startup founders chasing after investors, experienced investors raise a fund through the IPO process and then start looking for companies to acquire.

There are even rules around the amount of time that a SPAC has to put its funding to work, which is often 18-24 months.

The History of SPACs

Although the popularity of SPACs soared in 2021, where collectively they raised a record $100B in funding, SPACs have actually been around for decades.

The reality is that the broader use of SPACs as a funding vehicle was very stagnant for a long time. In 2019, just two years prior to the record funding year, there were only 59 created, and those firms deployed just $13B. That is less than the total amount of venture capital in the second quarter of 2019.

Why they Became so Popular

There are some common benefits to SPACs that have led to their growth. KPMG has a nice summary here.

For example, the timeline to complete a SPAC IPO is roughly one-third that of a typical IPO. Also raising capital can be easier than the process of a typical startup founder since SPACs are often led by experienced entrepreneurs and investors.

Why they are Suffering Now

One challenge facing SPACs is the previously mentioned timeline for when they must acquire a company or risk being dissolved. According to this site, there are over 700 SPACs that need to find an acquisition target and get it closed. If you look at the “Pending Merger” column and scroll down it is easy to see that there are a lot of SPACs still hunting for deals.

As with any investment sector, when the industry collectively sputters the value of the entire industry can take a hit.

It would be easy to attribute the fall in SPAC values to the over-arching challenges in the capital markets. But, that isn't the full story.

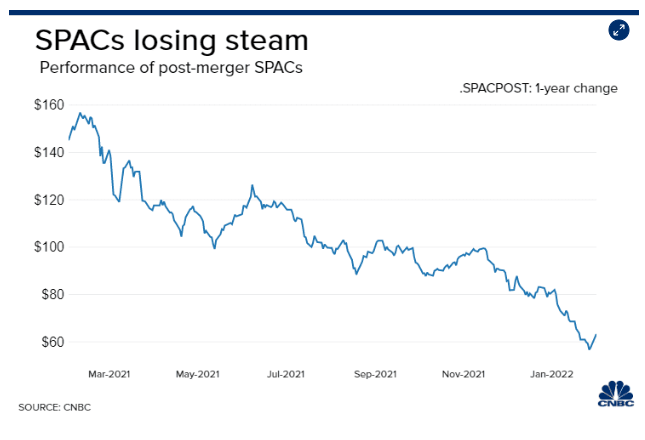

But, the real issue is performance. The companies where SPACs have invested their capital aren't performing as hoped, especially when you factor in post-IPO performance. On average, the ARR (Annualized Rate of Return) appears negative.

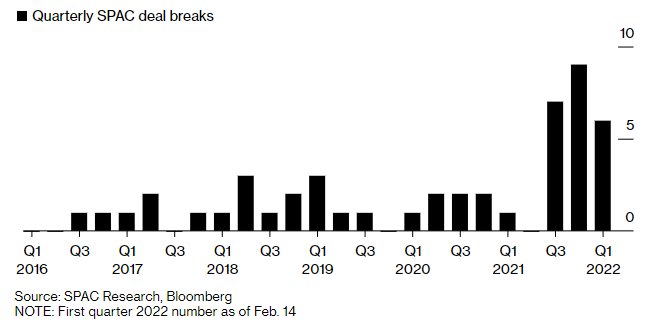

That, along with other factors, is leading to a lot of SPAC deals getting canceled.

Reading the Tea Leaves

As with any industry where things get rocky, I expect the SPAC industry to make some adjustments. Those adjustments will likely be partially self-imposed and potentially imposed by regulators who have watched as investor value has dissipated into thin air.

One place for change could be in loosening the investment time crunch. Having a smaller investment window is likely forcing some SPAC managers to consummate deals that they might not have otherwise gone after.

Also, many SPACs go into their IPO without identifying specific acquisition targets. We will probably see this change. Startup founders often do fundraising with target investors in mind. It doesn't feel unreasonable for SPACs to have at least a short least of targets that they share with their investors.