Worried about layoffs? Watch for these indicators.

Layoffs are started to stack up in the tech sector. If you are worried about layoffs look for these indicators.

Eleven thousand people, 11,000, lost their job today. They worked at Meta. That was the largest volume of layoffs at one company during this period. But Meta wasn’t the only tech company to let people go on November 9th. They were joined by Redfin, Cameo, Kaname, Coursera, and Root Insurance.

Keep in mind that this is just a listing of tech companies that announced layoffs on November 9th. Other big-name tech firms have announced layoffs recently.

Salesforce let 1,000 people go. Twitter sent 3,700 people home, not just because Elon Musk had acquired the company and needed a way to pay for the acquisition by reducing headcount.

All of these companies know what is coming - a tough time economically.

Just eight months prior, layoffs were at a record low.

I know what it feels like to be laid off. The first time I was axed wasn’t a big deal, because I had already submitted my resignation. I was moving to Japan, and the severance package just gave me some extra cushion during the move.

The next time was a month after I found a printout on the office computer that read, “Outsourcing your Accounting to India.” I ran the newspaper’s collections department which was housed in…the Accounting department. Our daughter was four months old at the time. It was good times.

The third time I was laid off I knew it was coming. I got an invitation to a next-day meeting downtime with my boss. Something felt odd about the timing and location of that meeting so I looked at his calendar. That meeting was his first of the day. Right after our meeting was a meeting with a peer on the same team and our shared assistant.

Layoff and unemployment levels

Unemployment was sitting at 3.7% in October. You have to go back to late 2019, just before the pandemic hit, to see a lower percentage of 3.5%. With layoffs starting to add up, November is almost guaranteed to see a jump in unemployment.

The last time unemployment saw a steep increase, outside of the pandemic, was during the Great Recession. Where unemployment nearly doubled from about 5% to nearly 10%. To put that into perspective, the total U.S. workforce sits at around 160 million people. A five percent unemployment means 8 million people would be unemployed.

During a given month, the Bureau of Labor Statistics reports a 1% layoff ratio, as compared to total employment.

While the tech sector is has had the most publicity around layoffs over the past few weeks, other sectors have high percentages. Including construction and arts and entertainment. You can find the layoff percentages per sector here to see how your industry is performing.

Being laid off is scary. It’s not always about losing your income. Plenty of people get laid off from jobs they enjoy and from working with people they enjoyed working with.

The good news is, if you know what to look for, you can usually see layoffs coming.

At a broader level, you should have noticed that the factors were ripe for layoffs in the tech sector. That will extend to other sectors, at a deeper level, very soon.

Factors that can lead to layoffs

Here are a few things you can look out for that might signal impending layoffs at your company.

Poor economic conditions - when the U.S. economy begins to sputter, every company is at risk of having to perform layoffs. One way to tell is to track economic performance across unemployment, wage growth, interest rates, new housing starts, gas prices, and more.

We are at a point right now where most of those factors are either flashing yellow (new housing starts) or red (interest rates). I’ve said this a lot lately, the factors keeping our economy propped up from a crash are unemployment and wage growth. But, as I said at the beginning of this article, that is changing for the worse.

- Poor financial performance - if your company is publicly-traded, watch for one or more consecutive periods of missed earnings compared to projections. If your company is a venture-backed startup, then pay attention to the burn rate (how much money the company spends per month) compared to the amount of money in the back. If the founders are struggling to raise another round and the ratio of capital in the bank to the burn rate is down to a few months, it is not a good thing.

- Investor pressure - we just saw this with Brad Gerstner’s open letter to Mark Zuckerberg, where he suggested that Meta needed to do a substantial round of layoffs. Perhaps a week later the layoffs were announced. Investors, of private or public companies, can put a tremendous amount of pressure on companies to get lean in order to preserve growth and revenue. If you see the pressure building it's a good sign that layoffs are likely imminent.

- Austerity measures - if you start to notice that your company has become much more fiscally-minded than previously, then it is time to pay attention. Examples might include cutting out all but essential travel, canceling certain benefits (they usually start with the more frivolous benefits), cutting bonus programs, etc.

- Hiring freezes - these usually precede layoffs. Hiring freezes don’t guarantee that layoffs are coming, but they are a sign that the company is managing its expenses very carefully. Typically, in order to avoid having to perform layoffs.

Interest rates - I mentioned this indicator above, but I wanted to revisit it independently. We are in a rising interest rate environment that is making borrowing capital more expensive. This is not only impacting consumers. It is also impacting businesses that became used to borrowing money, used to fuel growth, at nearly 0% interest. If those loans were set up as variable interest rates, which are often used for things such as lines of credit, the payment on those loans is started to increase dramatically. With another interest rate hike likely coming, those payments will increase even more. That adds an expense to a company’s bottom-line that has to be paid for somewhere - through layoffs.

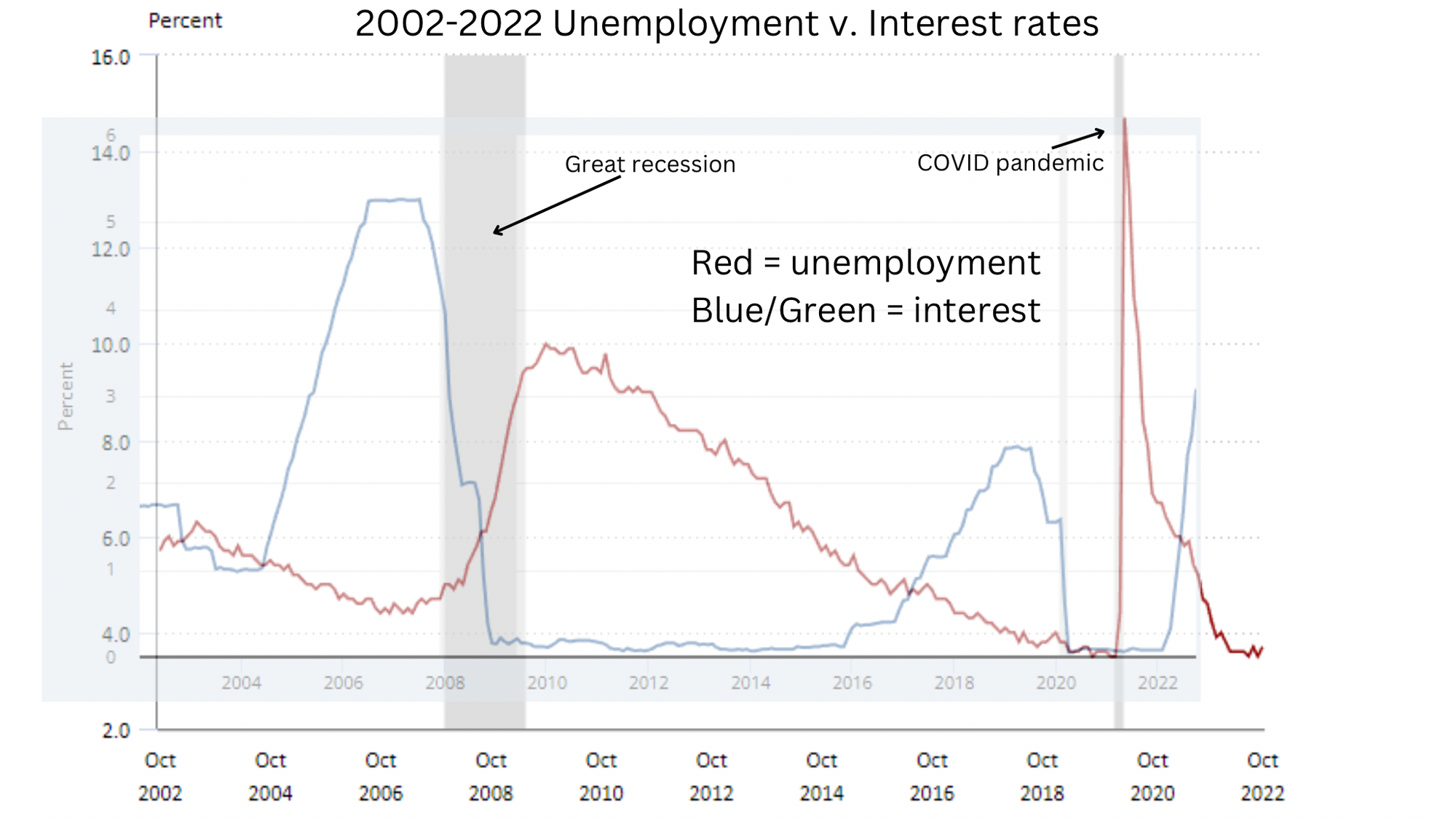

I decided to overlay, as best I can, unemployment with interest rates. If you look at the comparison below, you will see that rising interest rates tend to precede a rise in unemployment. The teal-ish line is interest rates, and the red is unemployment.

What was interesting to me was that interest rates rose but then declined ahead of the spike in unemployment. The gap between the two events was roughly one year.

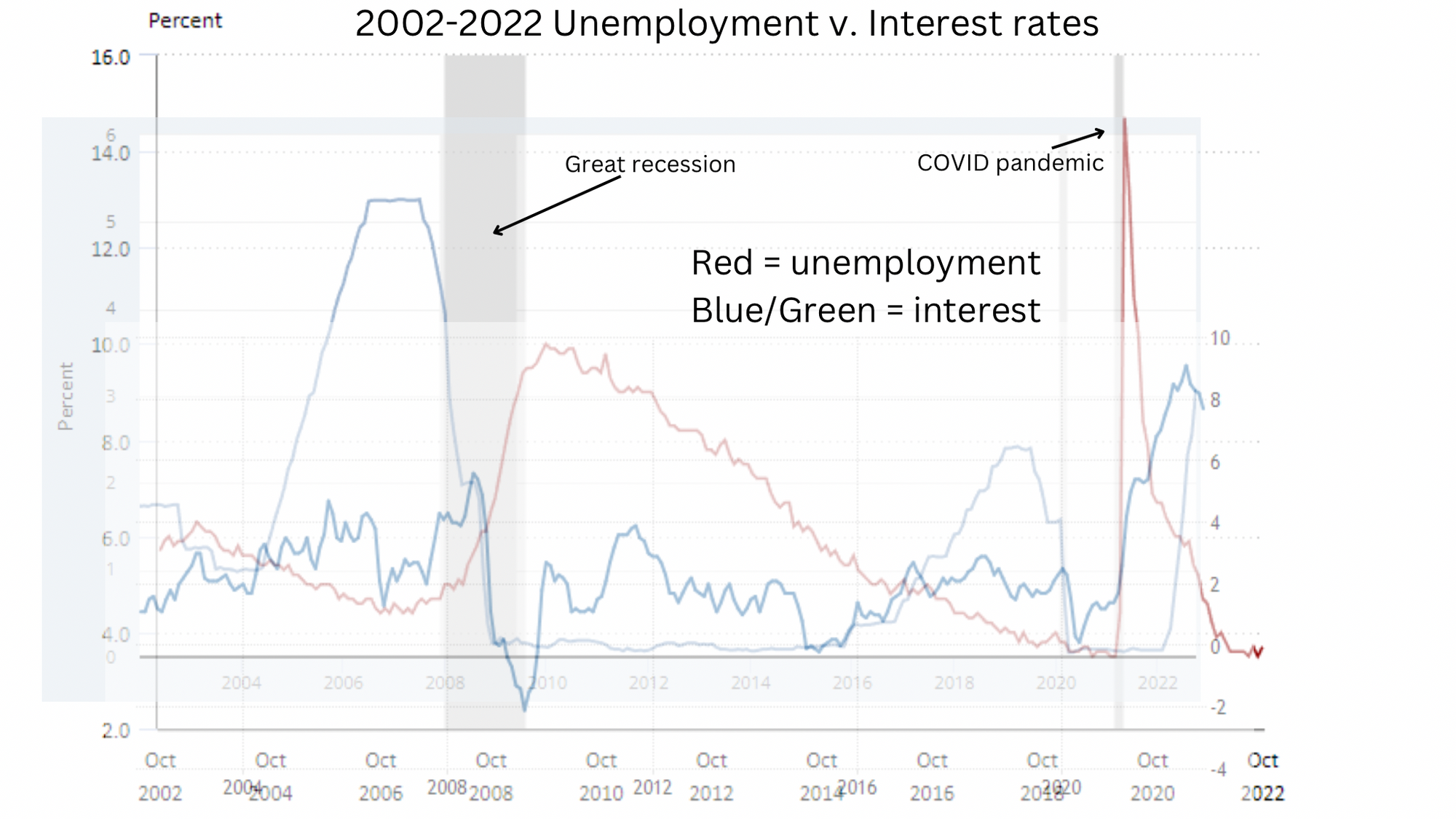

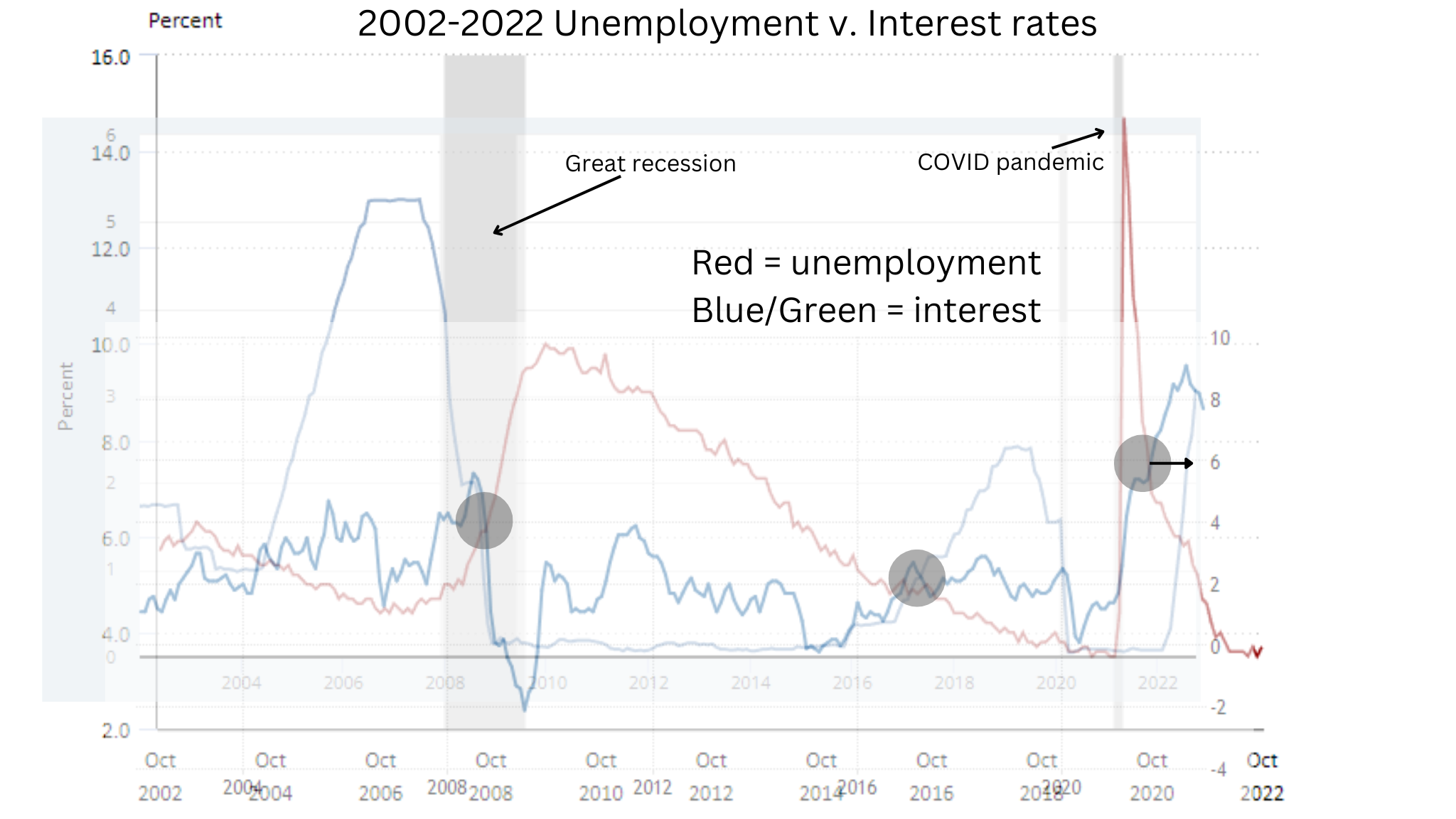

This time around rates have not had time to come back down. Why? David Tuyo encouraged me to dig deeper, see below, so I did.

Taking David’s advice I went looking for a third data set. I found one that I believe explains why rates didn’t drop ahead of unemployment rising. It’s inflation.

The new squiggly line in the chart is inflation. During previous periods of rising interest rates, that were followed one year or so later by increases in unemployment, inflation moved between 1-2% over a 2-4 year period. This time around it has bounced up roughly 6% in a two-year period.

In the past inflation has been volatile. Meaning although there have been periods of rising inflation, they have been followed relatively quickly by deflation. Not this time around. It is only the most recent months that inflation has trended back down. Yet, the rate of inflation is still higher than anything we’ve seen in the past twenty years.

Rising interest rate environments tend to last between 4-6 years, according to the chart. Which all goes back to why the Fed is signaling further rate increases.

I fully expect unemployment to hit between 5%-7% before we see layoffs settle down. Why? Because, using our data, it appears that all three data sets converge somewhere around 5-6%.

I’m accounting for another percent or two in unemployment because rates will likely continue up another 50-100bps in the near term.

Enjoy this post?

Please consider sharing it with other people who might be interested in this type of content.

Or, if you have suggestions for topics you'd like me to cover just hit reply and send me your suggestions.