How to have a stress-free relationship with money

If you have a resolution or goal to take charge of your money in 2024, then this one is for you.

I'm not a New Year's Resolution kind of guy.

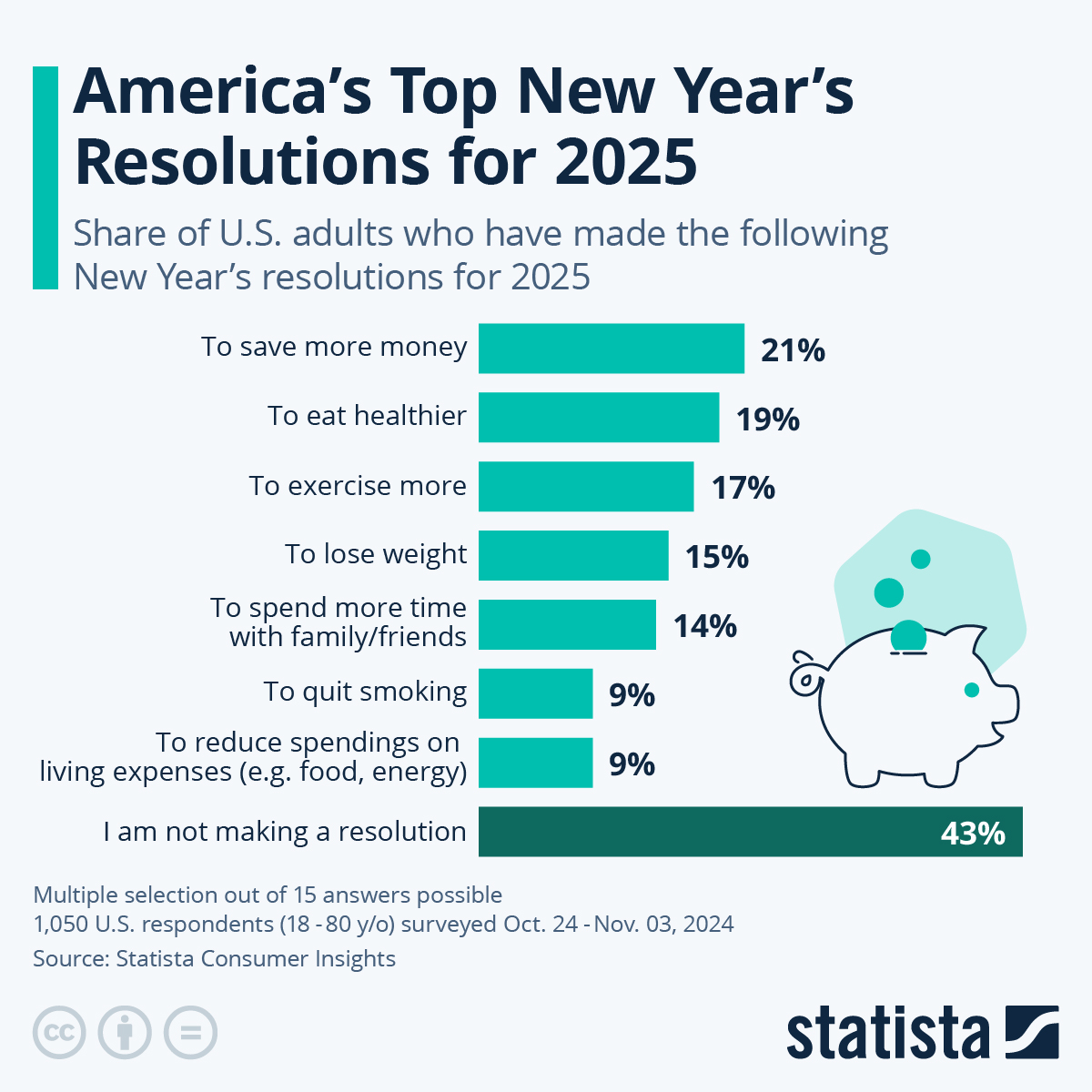

But, roughly 40% of Americans do set resolutions for the new year.

I suspect you can guess the top resolutions.

You will find more infographics at Statista

You will find more infographics at Statista

People are going into 2024 with a focus on money first and health second.

While the order of importance changes over time, money and health have been top resolutions for decades. Sometimes health wins out and other years money is the leader.

I suspect that money won out this year because we are coming off of some of the highest inflation rates in my lifetime.

I've been in finance for over 25+ years now, in some shape and form. So, it is not lost on me that most people struggle with their finances. What is also not lost on me is the amount of stress that money creates in people's lives. Even when they aren't living paycheck to paycheck, having a stress-free relationship with money is not guaranteed.

Some of that is because finance is not a language that everyone speaks. I've been lucky enough to have worked in finance for decades, on top of studying the topic on my own time. During that time, I've had a lot of family and friends reach out to me for help. As recently as last week someone I knew was asking for my advance about a home purchase.

Helping people with money decisions is one of the places I like to add value. It is why I committed to helping 1,000 people build a financial plan in 2023. I'm currently sitting at 912 people who have taken my course.

I recently realized that although the course accomplishes its goal of helping people build a financial plan, there is more to reaching stress-free finances than having a plan. There is no doubt that is part of it, but what about helping people better understand how debt works or how to invest their money?

So, I decided to go all in and write a book. I'm calling it Stress-Free Finances.

I am pouring my 25+ years of finance experience into the book.

But, this isn't just another finance book.

I'm giving you a ton of ways to turn what I share into actionable steps.

Including a boat-load of calculators and templates to help you take real steps towards:

- building a budget

- forecasting the impact of financial decisions on your budget

- determining how much you should have in savings

- what to do with your money when there is too much in savings

- how much life insurance you should have

- calculating the real cost of a car or home purchase

- a method of tracking investment decisions

- and more!

Not only will you be well-versed in all things finance, but your entire relationship with money will change.

If that sounds like a goal you'd like to accomplish, once and for all, then 2024 is your time!

To pre-order the book, at a discount, click the button below.

I anticipate the book being released in Q1 of 2024 and the cost, once published, being 3x the pre-order rate, so don't delay!